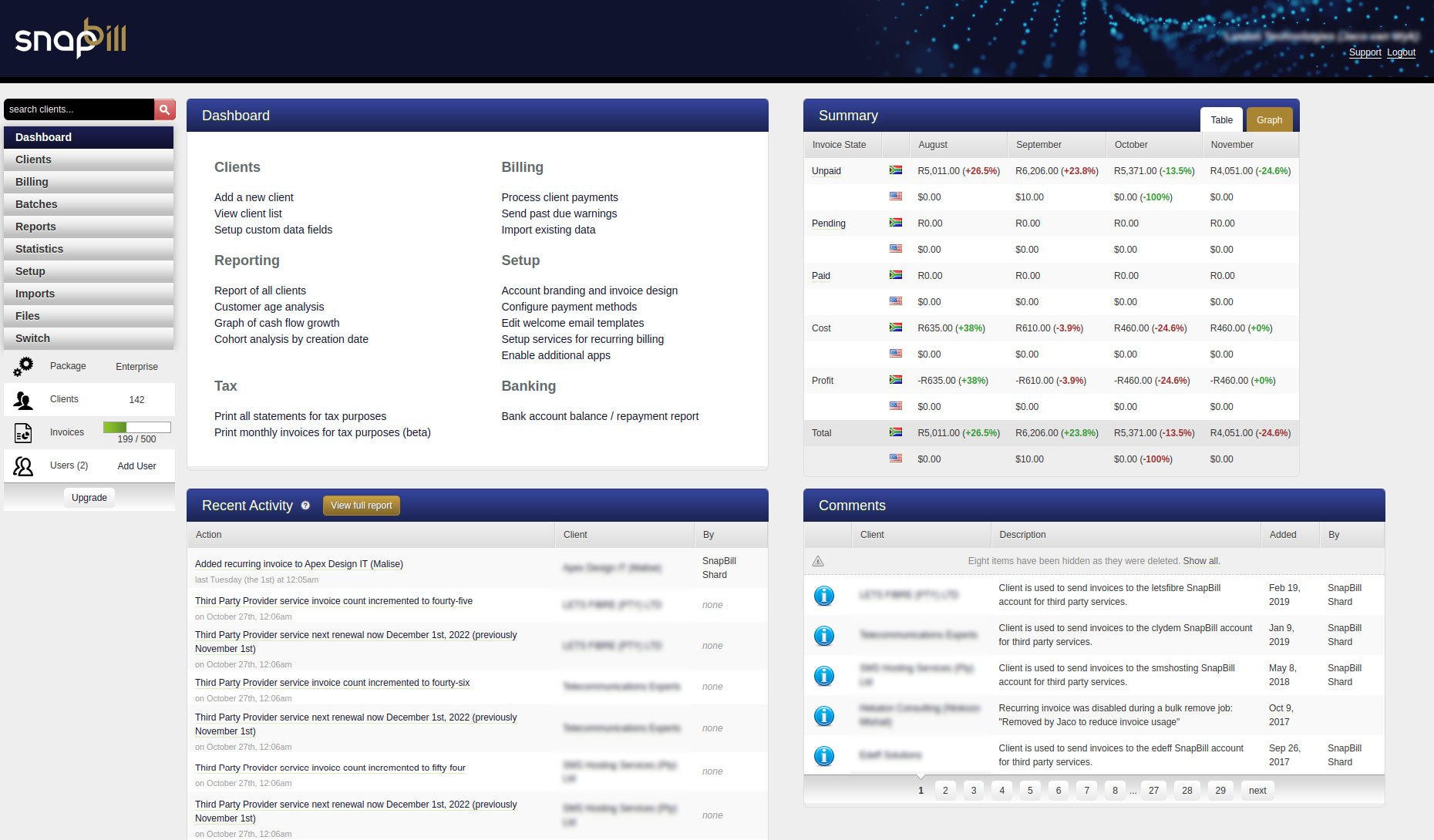

Online Cloud Invoicing

SnapBill is a billing system that allows you to easily sell online.

What is SnapBill?

SnapBill is a billing system that allows you to easily sell online. SnapBill is perfect for businesses requiring automated subscription or recurring billing with debit order payment collection facilities. The perfect debit order system for Direct Debit users.

PCI Compliance

SnapBill provides a fully compliant PCI environment for the storage of credit and debit card data to be processed via the debit order system.

Invoicing Currencies

Billing is supported in over 180 currencies and SnapBill provides access to various global payment gateways including Direct Debit in order to automate collections.

Subscription Invoicing Rules

SnapBill is a flexible billing system allowing you to setup your own subscription and recurring billing rules. Automated discounts or complex billing logic, SnapBill does it.

Online Invoicing Scalability

Online invoicing has never been more reliable. SnapBill runs on redundant scalable cloud infrastructure to meet the needs of any business.

Billing System Data Exchange

Billing system data stored on SnapBill can be seamlessly transferred to accounting software or access control systems via simple webhooks.

Online Invoicing API

SnapBill advanced billing and invoicing API allows you to easily connect to any mobile or web applications. We also integrate SnapBill with our E-Mandate solution.

SnapBill Features

Complete billing automation

Create recurring invoices & configure your services to sell effortlessly online.

Automate invoicing

Setup subscription charges to recur the way you want them to. We automatically generate invoices based on your schedule. You may load your own packages, products and services, choose whether to charge setup fees; configure trial periods and specify custom billing terms.

Recurring payment collections

Completely automate debit batch collections from customer credit cards or bank accounts, no development or integration required. We facilitate the generation, submission and reconciliation of debit batch collections through your payment gateway of choice.

Schedule email and text messages

Schedule and send out invoices, welcome emails and text messages, late payment warnings, statements or any other correspondence as required. Templates are easily modified using standard wiki code, PDF versions may be attached and message delivery may be configured based on timezone.

Synchronise with external systems

Connect and synchronise your billing data with external systems (e.g. web or mobile applications) via our API, webhooks or flexible Excel and CSV exports. Reports are easily modified and customised to meet your exact specification and needs, create, update and delete them as required.

Super flexible billing

Currencies, taxes & custom rules.

We do billing your way.

Powerful billing rules

Powerful billing rules can be setup without any programming knowledge. You may use billing rules to configure trial periods, setup custom tax behaviours, automate messages based on triggers or even create complex invoicing terms.

Payment modules on demand

Choose between our range of supported payment gateways. Enable multiple payment methods and allow us to switch your transactions in the most cost effective and efficient manner. We will integrate with any viable payment gateway.

Bill in any currency

All currencies (are supported from within our billing system. Enable currencies as required and we will automatically split revenue, reporting and statistics per client based on their selected currency.

Flexible tax configuration

Many possible tax configurations are supported. Enable multiple tax types, add or subtract taxes from totals. You have full control to specify taxes on your invoices as required.

Modular user permissions

Staff members in your organisation as well as outside users can be assigned modular permissions to your account. Create multiple access groups and place users in them. Permissions can be fine tuned to your exact specification. Giving you complete peace of mind and full control.

Custom fields for extend-ability

Add custom fields to customers and services and store the data you require. Set field types, default values, validation rules and descriptions. Choose when and where fields are available. Custom fields can easily be added to reports and used in the setup of powerful billing rules.

Smart statistics and reports

We help you make sense of your billing data.

Beautiful graphical statistics

Access graphical statistics on all your billing data. View statistics based on currencies, services, staff or terms. We make it easy for you to get a complete overview of your business and how it’s doing.

Customisable reports

Easily setup billing reports the way you want them to work. We allow you to choose which fields you want to show on your billing reports and you can download them as Excel spreadsheets or in CSV format.

Plug-in billing automation

Use our signup forms or integrate via our billing API. Connecting is a breeze.

Brandable signup forms

Setup and use our secure brandable signup forms. Easily link to our signup forms from your existing website or use them to allow your customers to order online without requiring your own website.

Share stored data

Quickly import existing billing data or setup your reports to allow for the export of data in the format needed. We allow you to export any billing data stored on the system, but we do encrypt payment details for everyone’s protection.

Integrate applications

Use our recurring billing API to integrate with your existing systems, applications and websites. We have a powerful REST based recurring billing API available.

Webhook automated provisioning

Webhooks allow you to provision your own infrastructure and services to customers after they have successfully signed up and/or made payment. Just enable the app and add a path to watch and we’ll return a JSON array that you can use as desired.

Security and peace of mind

PCI Compliance, encryption & redundancy.

PCI Compliant

We take security when storing sensitive credit card data extremely serious and we’ll manage your PCI compliance requirements when you store card information in our PCI compliant vault.

Encrypted data transfer

All data sent to and received from the system is encrypted with a high-grade encryption verified by the certificate authority Digicert.

Database failover

Our databases are completely redundant and feature automatic failover in the event of a specific geographic region experiencing connectivity or hardware issues.

Aggressive backup

Databases are backed up daily and stored on a 32 day rotation with the ability to restore data to within the last 5 minutes of activity in the event of a systems failure.

Elastic cloud infrastructure

Scale on-demand, no limitations.

Redundant databases

All our databases feature a high level of redundancy with real-time replication in multiple availability regions globally. Our in-memory data stores are replicated three fold, on the same machine, on separate machines within the same data centre and in at least one other disaster recovery site.

Server scalability

Our fully-managed web, job and batch servers scale on-demand and ensure system stability and performance beyond traditional cloud-hosted solutions.

Burstable resources

Should your online store get hit hard or you require to process a high volume of transactions at a moments notice, we have you covered with the ability to use more resources (CPU and memory) than what would normally be made available.

SnapBill Demo

SnapBill Pricing

We have a package for every business, start small and scale effortlessly as you grow.

Startup

Freelancers & Small Business-

Flexible branding

-

Payment modules

-

50 invoices / transactions

+ View detailed pricing structure

Premium

Growing & Medium Business-

Rule-based billing

-

Batch collections

-

Staff access & tracking

-

File storage

-

250 invoices / transactions

+ View detailed pricing structure

Enterprise

Large Business & Highly Scalable-

Invoice tracking

-

Advanced reporting

-

API access

-

Custom brandable forms

-

Integration assistance

-

Account manager

-

Priority support

-

Volume based pricing

*R2045/m base fee > 500 transactions

+ R3.00 per additional transaction

+ R200 per additional staff member

+ R6600/once-off setup per account

+ View detailed pricing structure

Contact Us

Read our FAQ for answers to common questions.

Direct Debit

Park Lane West Building

194 Bancor Avenue

Waterkloof Glen

Pretoria

0181

Direct Debit sets the standard for NAEDO and EFT debit order collection in South Africa.

Follow Us

Copyright © 2009-2024 Direct Debit (Pty) Ltd